Advertisement

-

Published Date

December 23, 2025This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

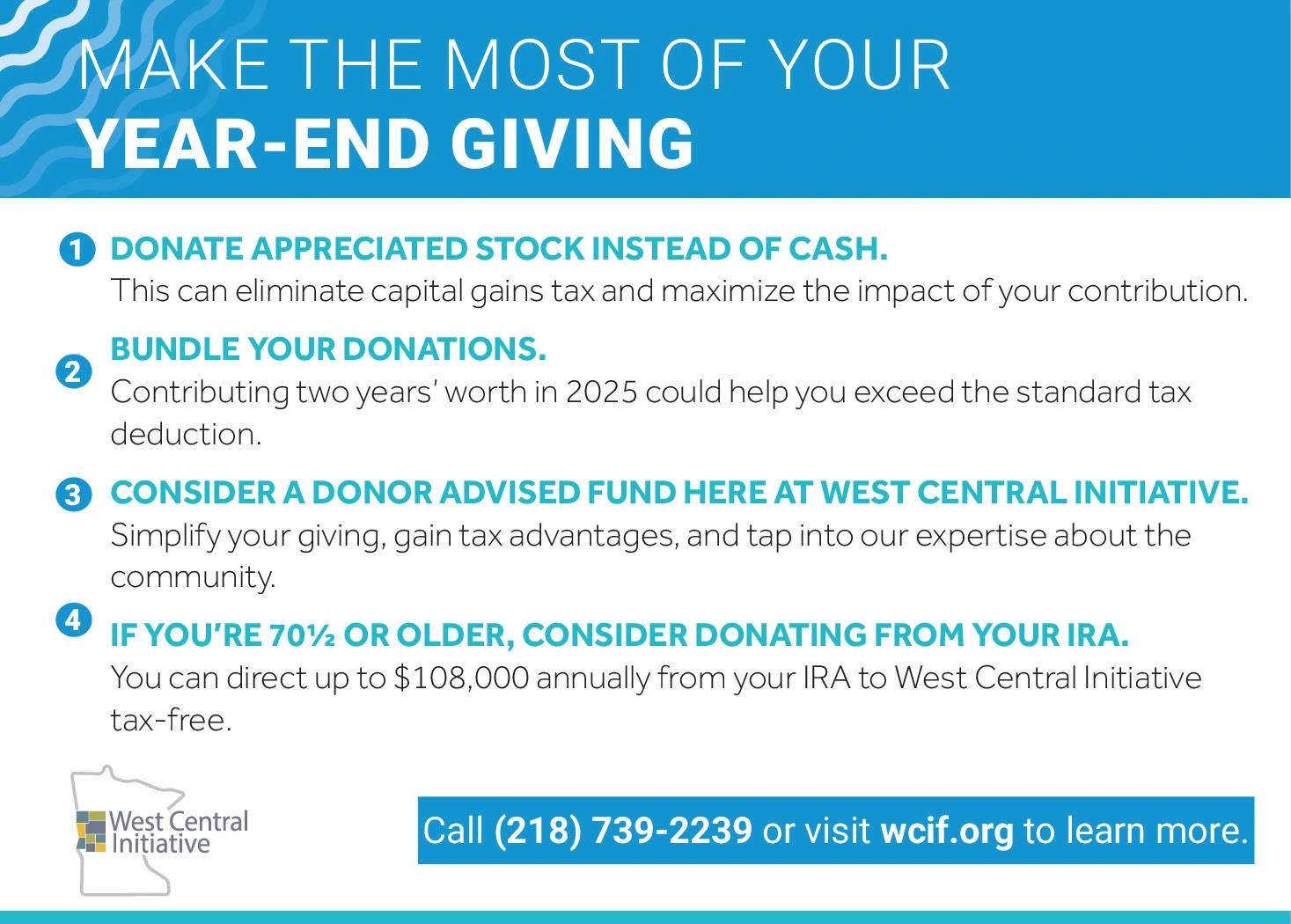

MAKE THE MOST OF YOUR YEAR-END GIVING 1 DONATE APPRECIATED STOCK INSTEAD OF CASH. 2 This can eliminate capital gains tax and maximize the impact of your contribution. BUNDLE YOUR DONATIONS. Contributing two years' worth in 2025 could help you exceed the standard tax deduction. 3 CONSIDER A DONOR ADVISED FUND HERE AT WEST CENTRAL INITIATIVE. Simplify your giving, gain tax advantages, and tap into our expertise about the community. 4 IF YOU'RE 70% OR OLDER, CONSIDER DONATING FROM YOUR IRA. You can direct up to $108,000 annually from your IRA to West Central Initiative tax-free. West Central Initiative Call (218) 739-2239 or visit wcif.org to learn more. MAKE THE MOST OF YOUR YEAR - END GIVING 1 DONATE APPRECIATED STOCK INSTEAD OF CASH . 2 This can eliminate capital gains tax and maximize the impact of your contribution . BUNDLE YOUR DONATIONS . Contributing two years ' worth in 2025 could help you exceed the standard tax deduction . 3 CONSIDER A DONOR ADVISED FUND HERE AT WEST CENTRAL INITIATIVE . Simplify your giving , gain tax advantages , and tap into our expertise about the community . 4 IF YOU'RE 70 % OR OLDER , CONSIDER DONATING FROM YOUR IRA . You can direct up to $ 108,000 annually from your IRA to West Central Initiative tax - free . West Central Initiative Call ( 218 ) 739-2239 or visit wcif.org to learn more .